Authentication Tailored for Mobile Payments: The 3D Secure 2.2 Protocol

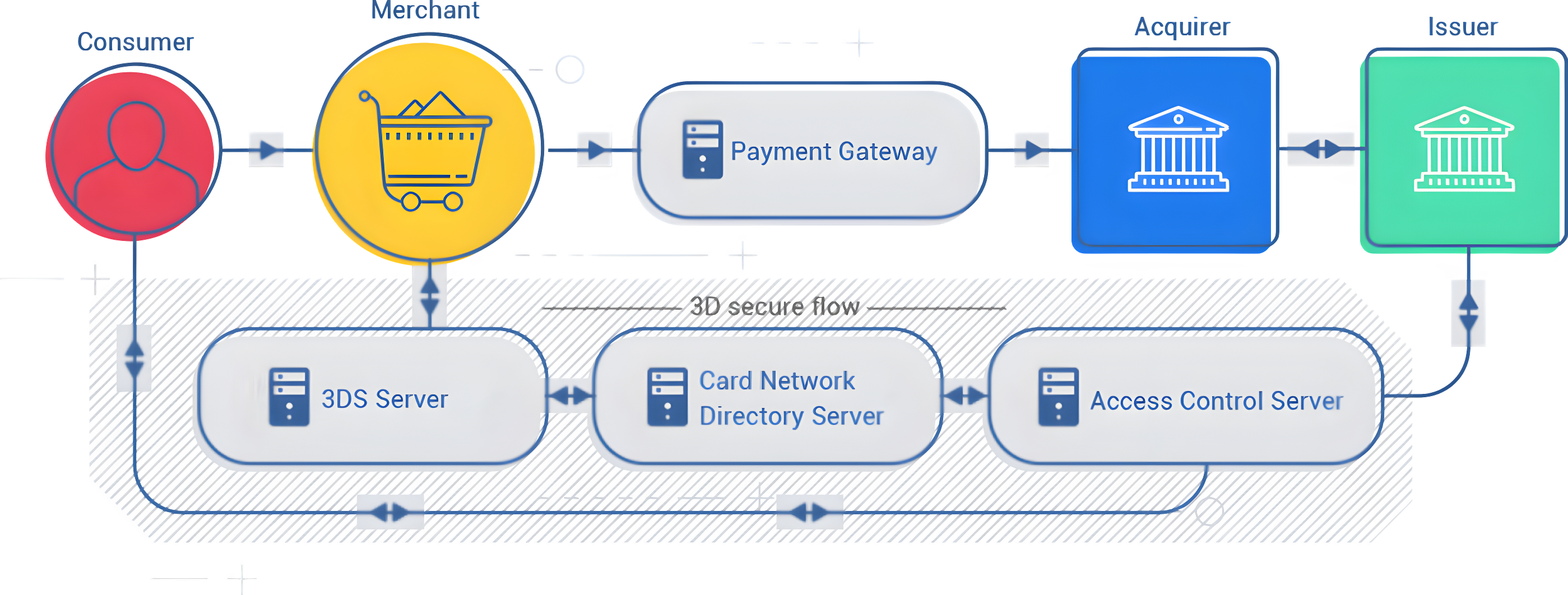

The 3D Secure protocol has evolved significantly to meet the needs of today’s mobile-driven payment landscape. Beyond fulfilling PSD2’s Strong Customer Authentication (SCA) requirements, 3D Secure 2.2 offers a range of enhancements that greatly improve the mobile payment experience.

The improved design dramatically increases the user experience on mobile devices by being fully compatible with mobile wallet applications and in-app transactions.

3D Secure 1 was

ridiculously non-user-friendly

-

Some users were unable to view the 3DS authentication page on their device

-

Compatibility issues when the authentication process is conducted on mobile browsers

-

Authorization page loading speeds cause issues and frustration

-

Actually see it as a security threat

-

Users felt the extra step was unnecessary, and often got irritated by it to the point where they would quit the purchase

-

Users are not always able to identify the authenticity of the popup window, which would often cause suspicion and result in transaction abandonment.

We are at the dawn

of a new era

-

With the addition of an SDK component, comprehensive integration with mobile apps is now possible, allowing merchants to natively integrate 3D Secure into their mobile apps.

-

Dramatically increases the user experience on mobile devices, including non-browser based platforms and mobile integration

-

The merchant’s platform will only require additional authentication if the risk is high – that will happen in only a small percentage of the transactions

-

Merchants can ensure that the authentication process looks and feels consistent with the rest of the app

-

Biometric authentication whilst still in the merchant’s app it will likely just feel like a valid security measure

-

Authentication activity will be invisible to the cardholder

Did you know that...

3D Secure 2.0 is on the Way With:

Frictionless Flow is perhaps the biggest improvement made to this 16 years old protocol. By performing risk-based authentication in the access control server (ACS), issuers are now able to approve a transaction without the need for input from the cardholder. That means no more annoying pop-up windows, and having to remember static passwords, removing friction from the checkout process; hence "frictionless flow".

Learn More

3D Secure 2.0 can be used for more than just online transactions. With the addition of "Non-payment authentication", the cardholder can be authenticated even without them making a purchase. This is extremely useful for adding credit cards to e-wallets (gone is the $1 charge just to validate your credit card!)

Learn More

Mobile devices have become an integral part of our lives, and consumers are increasingly shopping on their mobile devices. 3D Secure 2 has added a mobile SDK component, allowing merchants to natively integrate the 3D Secure process into their mobile apps, making the mobile checkout experience fast and seamless.

Learn More